Copyright © 2022 Global Sky Business. All Rights Reserved.

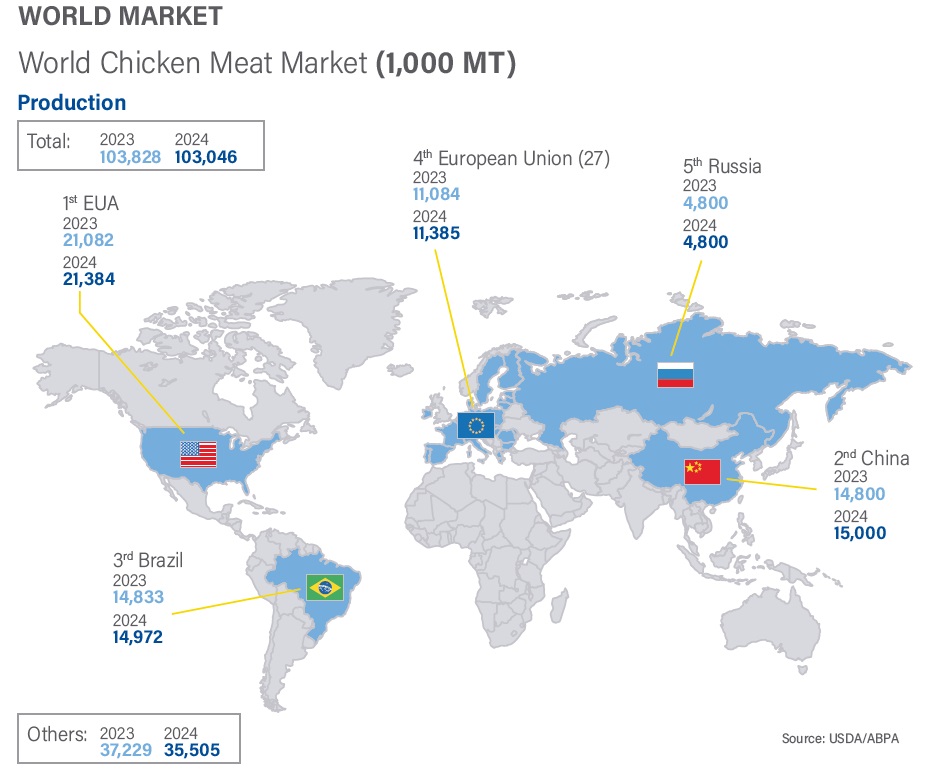

World Production of Chicken Meat

Brazil is the third largest Producer of Chicken Meat in the World and ranks first in World Exports.

Brazil is the 3rd largest producer of broilers in the world and the 1st place in exports.

Brazil is the third largest producer of chicken meat in the world, behind the United States (USA) and China. In 2009 it surpassed the USA, reaching the 1st place in exports. It also occupies a good position in egg production, 7th place.

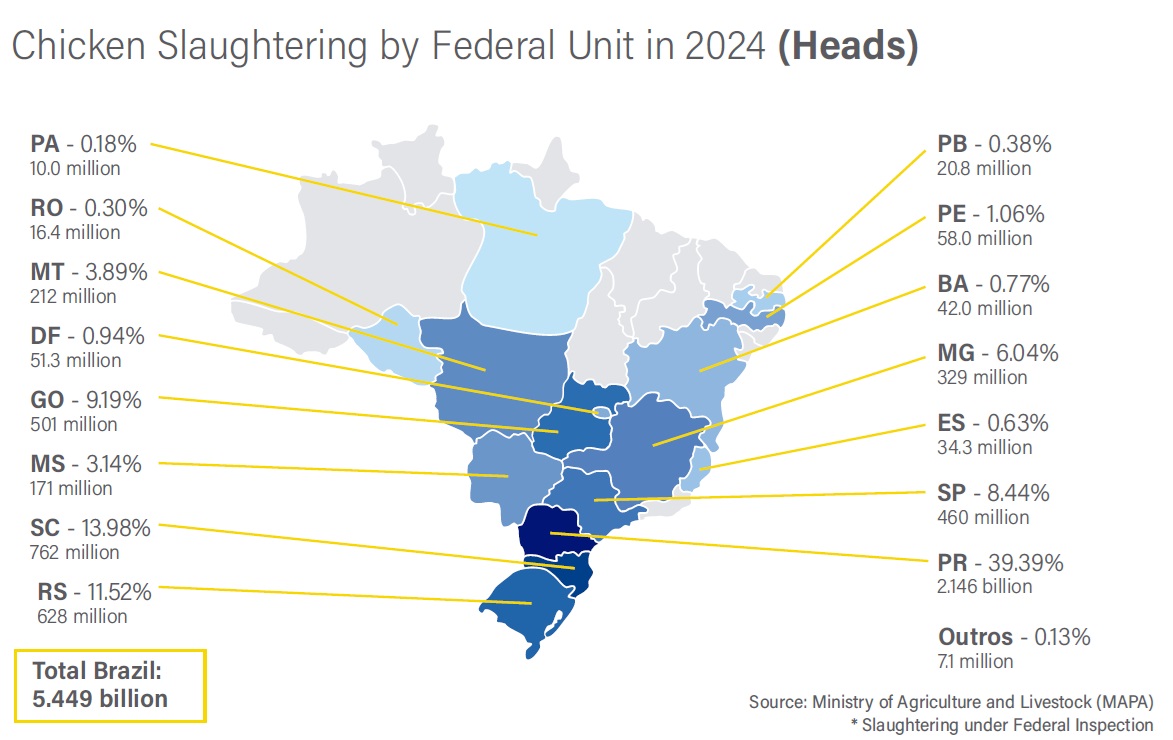

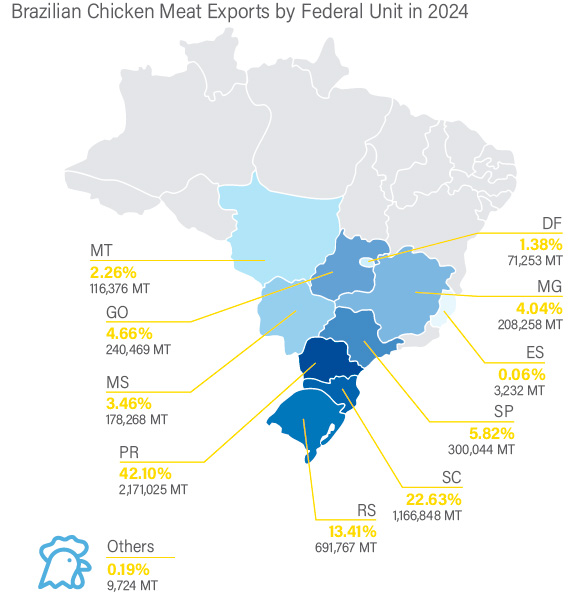

Poultry production generates around 2 million direct and indirect jobs throughout Brazil, contributing to a significant increase in the economy. The south and southeast regions are the largest producers, but there is a growing production in the center-west region due to the production of corn and soybeans. The states that produce the most chicken are the states of Paraná (27%), Santa Catarina (26%) and Rio Grande do Sul (23%).

The low cost with investment in facilities and high production of grains, favors the production of chickens in Brazil.

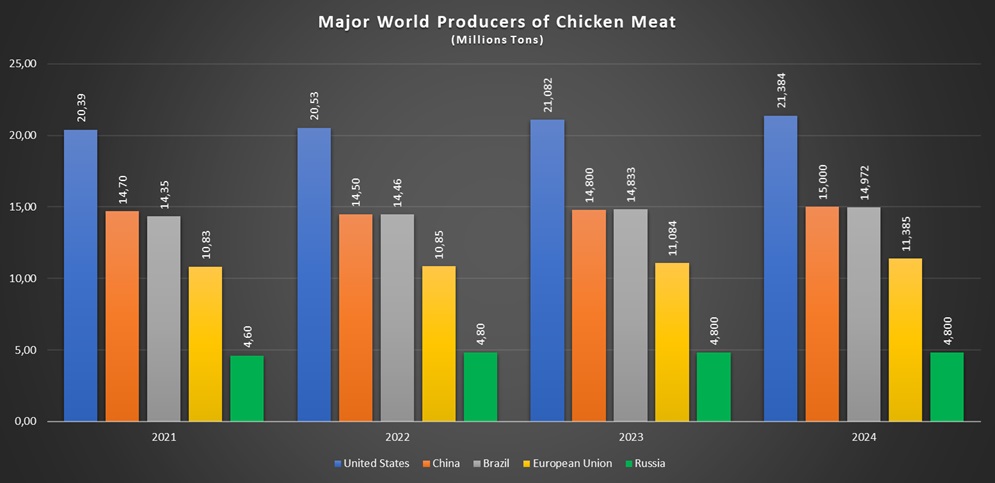

World Market for Chicken Meat (Millions tons)

Total: Production in 2024: 103,046 millions tons

In 2021, China surpassed Brazil in chicken meat production by 200,000 tons, placing China in second place in the world rankings and Brazil in third. In 2023, Brazil surpassed China in production by 33,000 tons, thus regaining second place, but in 2024, China increased its production to 15 million tons, again surpassing Brazil by 28,000 tons. Thus, in 2024, Brazil remains the third-largest chicken meat producer in the world with 14.972 billion tons.

Chicken Meat Production should have Record Yield in 2025/26 in Brazil

The Brazilian Association of Animal Protein (ABPA) projects new records of production, exports and consumption for poultry in Brazil for 2025/26.

Chicken meat, Brazil’s main protein on the international stage, was also discussed in detail.

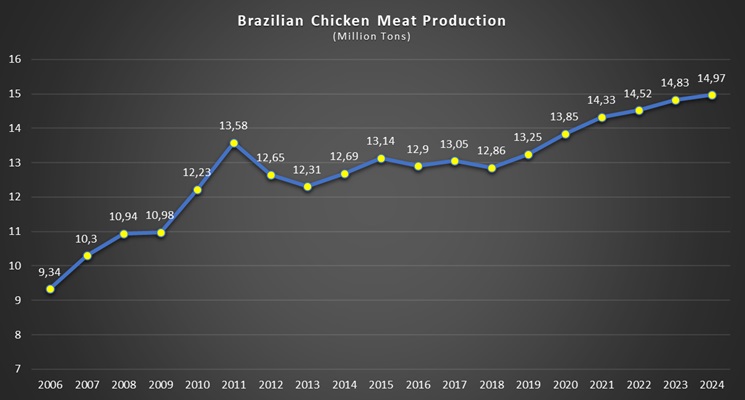

Production is expected to reach 15.4 million tons in 2025, and a further increase is estimated for 2026, reaching 15.7 million tons.

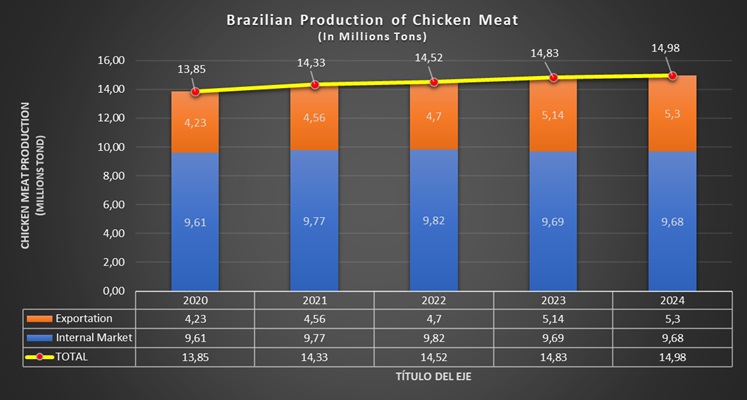

Brazilian exports are expected to decline slightly in 2025. Shipments are forecast to total 5.2 million tons, compared to 5.29 million tons in 2024.

This drop of up to 2% reflects the temporary impact of avian flu and the restrictions imposed by some markets.

However, the sector is already negotiating the reopening of these destinations and expects to reach 5.5 million tons exported in 2026, an increase of 5.8%.

In the Brazilian domestic market, availability is also growing. Per capita consumption is expected to reach 2,025 kilograms in 47.8 years, up from 45.5 kilograms in 2024.

For the ABPA, this guarantees stable production and strengthens exporters’ confidence, keeping Brazil at the top of the list of global suppliers.

Evolution of Brazilian Chicken Meat Production

Brazilian chicken meat production by destination

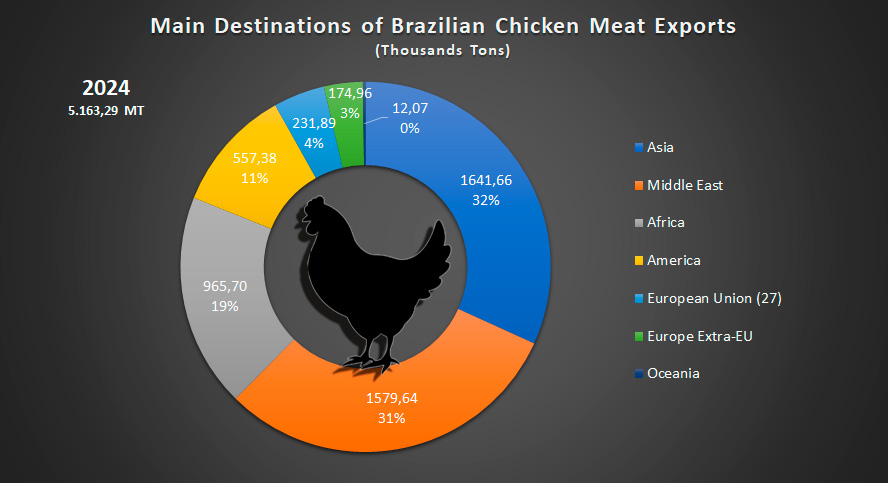

BRAZILIAN EXPORTS OF CHICKEN MEAT

According to data from the Secretariat of Trade and International Relations of the Ministry of Agriculture and Livestock (SCRI/MAPA), from January to July 2025 alone, exports of chicken meat and offal exceeded US$5.47 billion, totaling more than 2.9 million tons.

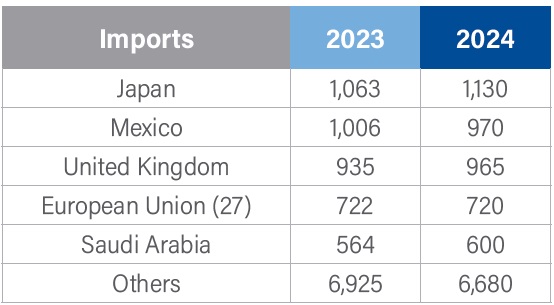

The main destinations for Brazilian chicken meat are: Saudi Arabia, China, the United Arab Emirates, Japan, Mexico, and the Philippines. For chicken offal, the destinations are: China, Hong Kong, Ghana, and Saudi Arabia.

According to the National Supply Company (CONAB), chicken meat production is estimated to reach a new record in 2025, projected at 15.48 million tons, a 1.5% increase compared to 2024.

Brazil, the world leader in exports of the product, will be responsible for more than a third of the estimated increase, as “is well positioned to profit from growing demand from the European Union and the UK.” The forecast is something around 4.180 million tons of in natura product.

For the USDA, Brazil is also able to meet the growing imports from East Asia and the Middle East. But he points out that the increase in demand from Asia, especially from Japan and China, will also support the expansion of exports from Thailand.

The US agriculture body ends its analysis by noting that, despite the increase in domestic production, chicken meat imports from China will remain firm. The expected increase will be limited, not reaching 3%.

Note that, in all its projections, the USDA continues to disregard exports and imports of chicken feet/paws. Therefore, the effective values will be higher than those indicated, especially with regard to Brazil and China.

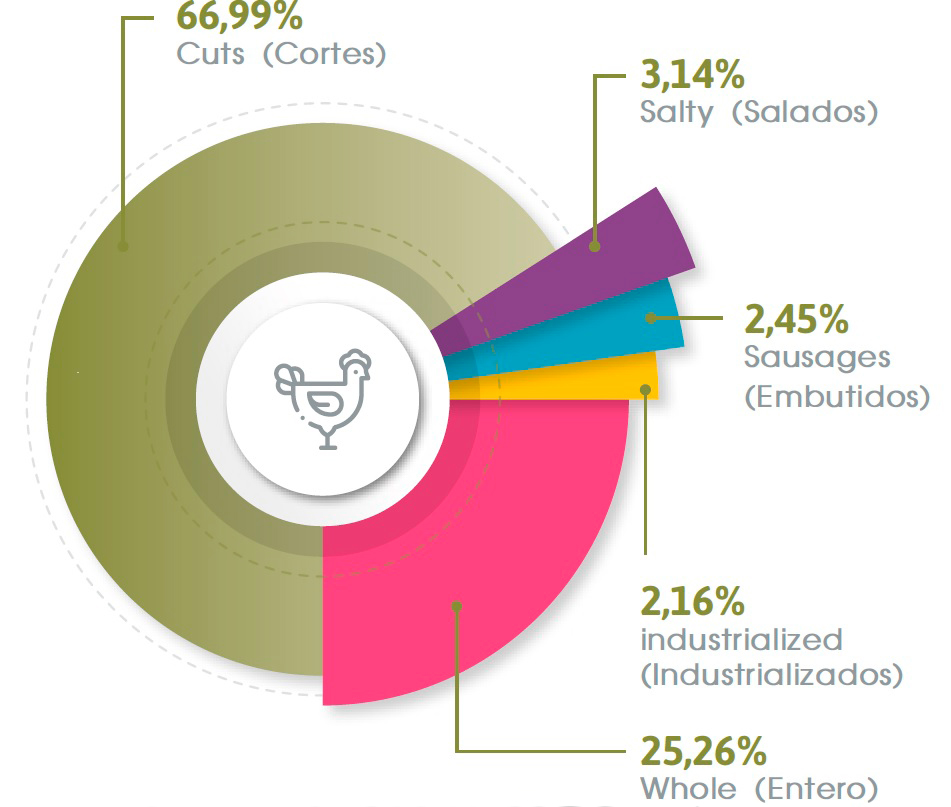

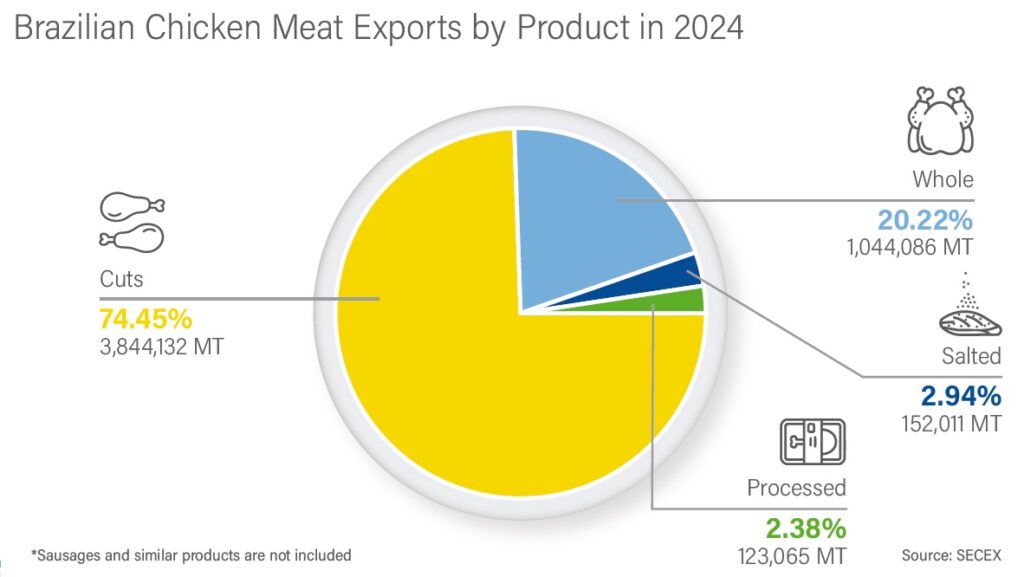

Brazilian Meat Exports of Chicken by Product in 2024

Destination of Brazilian Production of Chicken Meat in 2024

Chicken Slaughter by State in 2024

Chicken Meat Exports by State in 2024

World's Largest Exporters of Chicken Meat (Millions Tons)

World's Largest Importers of Chicken Meat (Millions Tons)

Brazilian Chicken Meat Export Results in 2024

Exports Revenue 2021

Volume Exported 2021

Average Price 2021

Previous

Next

Projection by the MAPA agency in Brazil: in a decade, chicken meat production could grow close to 4% per year

The MAPA organization projected the possible evolution of Brazilian chicken meat production until 2031.

He foresees that, in this period of time, the total produced by the sector may increase at a rate of approximately 2.5% per year, accumulating an increase of almost 28% in 10 years.

However, if there are no obstacles, production can present much more significant levels of evolution, close to 4%. This is what SPA projects as the upper limit. In this case, the total produced in 2031 could reach 21.6 million tons, about 46% more than the forecast for the current year.

Chicken Breasts Grilled

Chicken Drumsticks Grilled

Chicken Wings Grilled

Previous

Next

Brazilian Chicken meat exports by 2022 could reach 4,650 thousand tons

Monitoring covering 15 years of exports – 2007 to 2021 – suggests that it is not the month of January that we will experience fewer shipments of frango meat. In the average of 15 years, the volume recorded in January corresponds to 7.23% of the annual total, while the record occurred no more than July, with 9.06% two annual shipments.

Naturally, exports do not have mathematical performance: they depend on moments, especially economic ones. But I assume that in 2022 we will accompany the average two last 15 years, the monthly results will be, approximately, those projected in the graph below.

The projection is restricted to raw frango meat – cuts and whole product. And it indicates, for the year, a volume close to 4.4 million tons, about 3.5% more than or exported in 2021.

But if we also consider the shipments of salted frango meat and two industrialized frango meats, the annual total can reach and exceed 4,650 thousand tons, since the product in nature corresponds (average of 2021) to 94% two sector shipments. In this case, the annual increase – considering the four main exported items – would be greater than 4%.

It is interesting to note that the volume shipped in the month of January 2022 – 317.7 thousand tons of natural product – corresponds to the second best result recorded in the month of January. If the performance is maintained, the numbers now projected could be exceeded. The problems – especially sanitary – faced by other exporting countries apontam nessa address.

AVAILABILITY:

Immediate

PRODUCT ORIGIN:

Brazil

DELIVERY TERM:

45 days

BUYER'S DOCUMENTS:

LOI & RWA

INCOTERMS:

FOB / CIF

PAYMENT TERMS:

30% Advanced TT. 70% Remaining, L/C against Shipping Documents

AVAILABILITY:

Immediate

INCOTERMS:

FOB / CIF

BUYER'S DOCUMENTS:

LOI & RWA

DELIVERY TERM:

45 days

PRODUCT ORIGIN:

Brazil

PAYMENT TERMS:

30% Advanced TT. 70% Remaining, L/C against Shipping Documents

We offer a complete range of commodities originating in South America.

Contacts

- Brazil: Av. Santos Dumont N°1883, Floor 5th, office 532/533, Aero Empresarial Building, Lauro de Freitas, Bahia, Brazil.

- Argentine: Tucuman 1946, Office N°04 - Córdoba, Argentina.

- info@globalskybusiness.com

- +55 71 98205 1492

Main Commodities

Subscribe

Follow our newsletter to stay updated about agency.